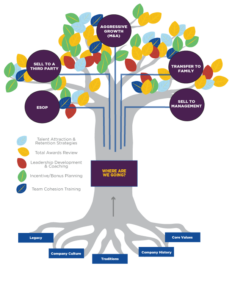

Failing to plan is planning to fail.

Planning is about building, retaining, and perhaps passing on your wealth to the next generation. It involves recognizing and coming to grips with many complex operational, family, individual, and business issues; issues that must be addressed for the business to move forward in the evolution process.