“Main Street Lending Facility Update” FAQs – Update June 9, 2020

Published May 1, 2020

- Articles

This post has been updated as of June 9, 2020

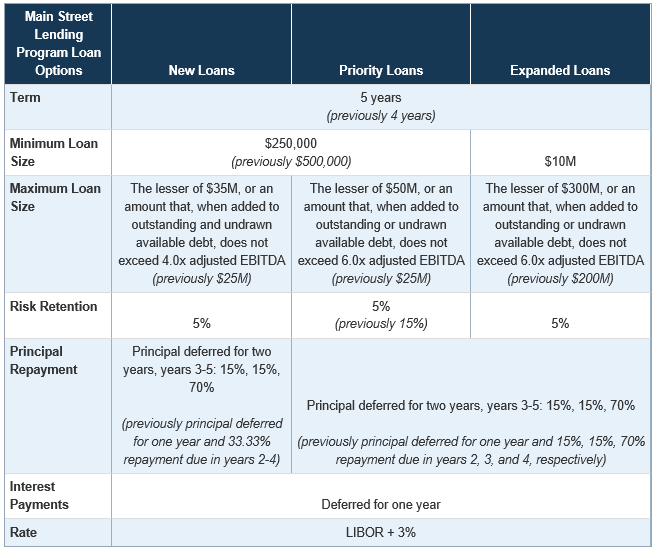

On June 8, the Federal Reserve Board of Governors announced changes to the Main Street Lending Program, which was originally announced on April 9 and updated previously on April 30. In the announcement, the FRB made the key changes below.

- Lowering the minimum loan size for certain loans to $250,000 from $500,000;

- Increasing the maximum loan size for all facilities;

- Increasing the term of each loan option to five years, from four years;

- Extending the repayment period for all loans by delaying principal payments for two years, rather than one; and

- Raising the Reserve Bank’s participation to 95% for all loans.

In the press release, the FRB said they expect the Main Street program to be open for lender registration soon and to be actively buying loans shortly afterwards.

We have outlined the program below, and items highlighted are updated.

Who is an eligible lender?

- US Insured depository institutions

- US Bank Holding Companies

- US Savings and Loan Holding Companies

Who is an eligible borrower?

- Business with up to 15,000 employees or up to $5.0 billion in 2019 annual revenues

- Business that is created or organized in the US or under the laws of the US

- Significant operations in and a majority of its employees based in the US

What are the programs?

- Main Street New Loan Facility

- Main Street Priority Loan Facility

- Main Street Expanded Loan Facility

What is the minimum that can be borrowed?

- For New and Priority Loans, Minimum loan size is $250,000

- For Expanded Loans, Minimum Loan size is $10 million

What are the terms on these loans?

- The loans will have a maturity of 5 years

- Interest Payments deferred for 1 year

- Amortization of principal deferred for 2 years

- Years 3 and 4 – 15% of principal due at end of year,

- Year 5 – 70% of principal due at end of year

- Interest rate is adjustable – LIBOR + 3%

- No prepayment penalty

- Secured or Unsecured each loan type

- Collateral for Expanded Loans – existing, or can be added during upsizing

Program Summary Table (Source: www.federalreserve.gov)

Can I use funds to repay existing debt?

- No

What attestations are required for these loans?

- The Lender must attest that the proceeds of the loan will not be used to repay or refinance pre-existing loans or lines of credit made by the lender to the borrower, except in event of default.

- The borrower must commit to refrain from using the proceeds of the loan to repay other loan balances.

- The borrower must commit to refrain from repaying other debt of equal or lower priority, with the exception of mandatory principal payments, unless the borrower has first repaid the Main Street loan in full.

- The lender must attest that it will not cancel or reduce any existing lines of credit outstanding to the borrower, except for default. The borrower must attest that it will not seek to cancel or reduce any of its outstanding lines of credit with the lender or any other lender

- The borrower must attest that it requires financing due to the exigent circumstances presented by the coronavirus disease 2019 (“COVID-19”) pandemic, and that, using the proceeds of the loan, it will make reasonable efforts to maintain its payroll and retain its employees during the term of the loan.

- The borrower must attest that it meets the EBITDA leverage condition stated above specifying the maximum size of the loan.

- The borrower must attest that it will follow compensation, stock repurchase, and capital distribution restrictions that apply to direct loan programs under section 4003(c)(3)(A)(ii) of the CARES Act.

Are there fees for this loan?

- The borrower will be charged an origination fee of up to 100 basis points of the principal amount of the Loan for New and Priority Loans.

- This fee is 75 basis points for the upsized tranche for Expanded loans.

- In addition, the lender will pay a facility fee of 100 basis points of the principal amount of the loan participation purchased by the facility for New and Priority Loans. The Lender may require the borrower to pay this fee.

- This fee is 75 basis points for the upsized tranche for Expanded loans.

Can this loan be forgiven?

No.

How long does this program last?

The facility will cease purchasing participations in Eligible Loans on September 30, 2020, unless the Board and the Treasury Department extend the Facility.

How do I apply?

Eligible entities should contact their existing lenders pending the release of any further guidance.

Forms required for both lenders and borrowers can be found at

Links to Program information

Federal Reserve Press Release: https://www.federalreserve.gov/newsevents/pressreleases/monetary20200608a.htm

Main Street New Loan Term Sheet: https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200608a1.pdf

Main Street Priority Loan Term Sheet: https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200608a2.pdf

Main Street Expanded Loan Term Sheet: https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200608a3.pdf

Main Street Lending Program FAQs: https://www.bostonfed.org/mslp-faqs

We’re Here to Help

MCM CPAs & Advisors can help advise you through these important programs. For more information, contact covidbank@mcmcpa.com and a member of MCM CPAs & Advisors COVID-19 Solutions Group will be in touch.